cayman islands tax residency

This may be relevant or desirable for citizens of European Union EU member states for the purposes of compliance with Reporting of Savings Income Information Law. The Cayman Tax Information Authority can grant tax residency certificates to individuals ordinarily resident in the Cayman Islands.

Buying Property In The Cayman Islands Provenance Properties

Cayman imposes no income capital gains payroll or other direct taxation on corporations or individuals resident in the Cayman Islands.

. Unlike other programs the Cayman Island Golden Visa Program refers to a permanent residence program and not immediate citizenship as compared for example to the St Kitts and Nevis. PHYSICAL DEPOSITS CASH CHEQUE Funds may be remitted to the Cayman Islands Government CIG at the Royal Bank of Canada and Dropbox at the Government Administration Building GAB by a physical deposit of KYD USD Cash. The Cayman Islands does have a double tax treaty with the UK but it is narrowly drafted and therefore can only be relied upon in certain limited circumstances.

They have no income tax no property taxes no capital gains taxes no payroll taxes and. Cosmopolitan destination offering a wonderful lifestyle and. The Tax tables below include the tax rates thresholds and allowances included in the Cayman Islands Tax Calculator 2021.

Irish tax residency is primarily determined by the central management and control test. The list below summarizes some of its characteristics more specifically the types of taxes that. For example purchasing this three-bedroom luxury beach home at The Residences at Seafire which offers optional turnkey furniture packages from Restoration Hardware qualifies buyers to apply for Cayman Islands.

US Citizens is one of the top Residence by Investment Visa Programs available to expatriates seeking to take a break from the IRS and US tax filing. You can enjoy tax benefits such as no inheritance tax no income tax no property tax and no capital gains tax. Benefits of Residency You can reside in the Cayman Islands legally in some cases with the right to work and conduct business.

For the purposes of the Common Reporting Standard CRS all matters in connection with residence are determined in accordance with the CRS and its Commentaries. The Income tax rates and personal allowances in Cayman Islands are updated annually with new tax tables published for Resident and Non-resident taxpayers. The new legislation introduces the opportunity for foreign individuals to apply for a residential certificate for investment.

Last updated 19 March 2020. The Cayman Islands laws allow the location to be a tax haven through the fact that there is no corporate income tax no payroll tax or Cayman Islands capital gains tax and no other direct taxes for companies. The Cayman Islands is a well-known tax haven where you can establish residency without much hassle and as a British Overseas Territory it offers high-quality legal services health care and education.

The Cayman Islands residency programme is suitable for highly successful investors and entrepreneurs who live very international lives. If you fail the conditions to split the tax year into resident and non-resident periods you will be treated as resident in the UK. Becoming a resident of the Cayman Islands is therefore an interesting option for wealthy people seeking to lower their tax bills by moving to a highly livable country.

Income Tax Rates and Thresholds. A minimum 30 days residency is required. Since no corporate income capital gains payroll or other direct taxes are currently imposed on corporations in the Cayman Islands corporate residency is not relevant in the context of Cayman Islands taxation.

The Cayman Islands tax system is one of the most advantageous for investors. In addition to having no corporate tax the Cayman Islands impose no direct taxes whatsoever on residents. Cayman Islands Residents Income Tax Tables in 2021.

Taxes are however imposed on most goods imported to the Islands and stamp duty especially on direct and indirect transfers of Cayman Islands real estate is a significant head of taxation in the Cayman Islands. As a person of independent means. The simplest and quickest path to permanent residency in the Cayman Islands is through the purchase of developed real estate valued at US24 million or higher.

Entities engaged in scheduled trade and business in the Cayman Islands as defined in the Trade Business Licensing Law are required to have a trade and. For each dependent named in the Certificate there is also a fee of CI1000 US121951 per annum. While this will cost KYD20000 USD24000 it allows the investor.

Tax residency under Irish double taxation treaties To fall within the Irish tax regime and benefit from Irelands double taxation treaties the Cayman Islands incorporated SPV must be resident in Ireland for tax purposes. Becoming a resident of the Cayman Islands is therefore an interesting option for wealthy people seeking to lower their tax bills by moving to a highly livable country. Permanent Residence on the basis of eight years residence Eligibility.

Ministry of District Administration Tourism Transport USD Executive Revenue. There are no direct taxation laws in the Cayman Islands and therefore there are no domestic provisions which define tax residence generally or which provide criteria for determining tax. The Cayman Islands is a well-known tax haven where you can establish residency without much hassle and as a British Overseas Territory it offers high-quality legal services health care and education.

Tax Status for Expats. On the basis of eight years residence. In addition to Permanent Residency the Cayman Islands offers a Residency Certificate requiring just 12 million investment in real estate.

When moving from a country that enforces taxation upon its citizens to the Cayman Islandsa country without direct taxthere are certain rules and regulations that need to be adhered to in relation to your home country. Capital Gains Tax CGT for Non-UK Residents. Gain full residency and complete tax efficiency through the establishment of a corporate entity in the Cayman Islands The Benefits 100 exempt from corporate capital gains sales income tax and import duties.

Here we discuss the differences between the. Any person who has been legally and ordinarily resident in the Cayman Islands for a period of at least eight years but not more than nine years other than the holder of a. This permits 25-year residence to wealthy individuals who invest in businesses that contribute to the prosperity of the islands on certain conditions.

An applicant must invest a minimum of CI1000000 US1219513 of which at least CI500000 US609757 must be in developed residential real estate in Grand Cayman AND must either demonstrate a continuous source of annual income of CI120000 US146342 without the need to engage in gainful employment in Grand Cayman OR open an account with a. The fee to make an application for a Residency Certificate for Persons of Independent Means is CI500 US60975 and if the application is approved there is an issue fee of CI20000 US2439024.

Cayman Islands Residency By Investment Tax Efficient Residency

The Cayman Island Dual Luxury World Second Passport Citizenship Residency By Investment

A Guide To Cayman Islands Exempted Company Law

Cayman Islands Lifestyle Solutions

Cayman Islands Cayman Island Grand Cayman Island Caribbean Islands

Cayman Islands Tax Efficient Residency Visa

How To Get Cayman Islands Residency And Pay Zero Tax

Important Changes For Cayman Islands Investment Funds Aml Regulations Vistra

The Cayman Islands Residency By Investment Programme Latitude

The Cayman Islands Residency By Investment Programme Latitude

Where To Buy Property In The Cayman Islands Bricks Mortar The Times

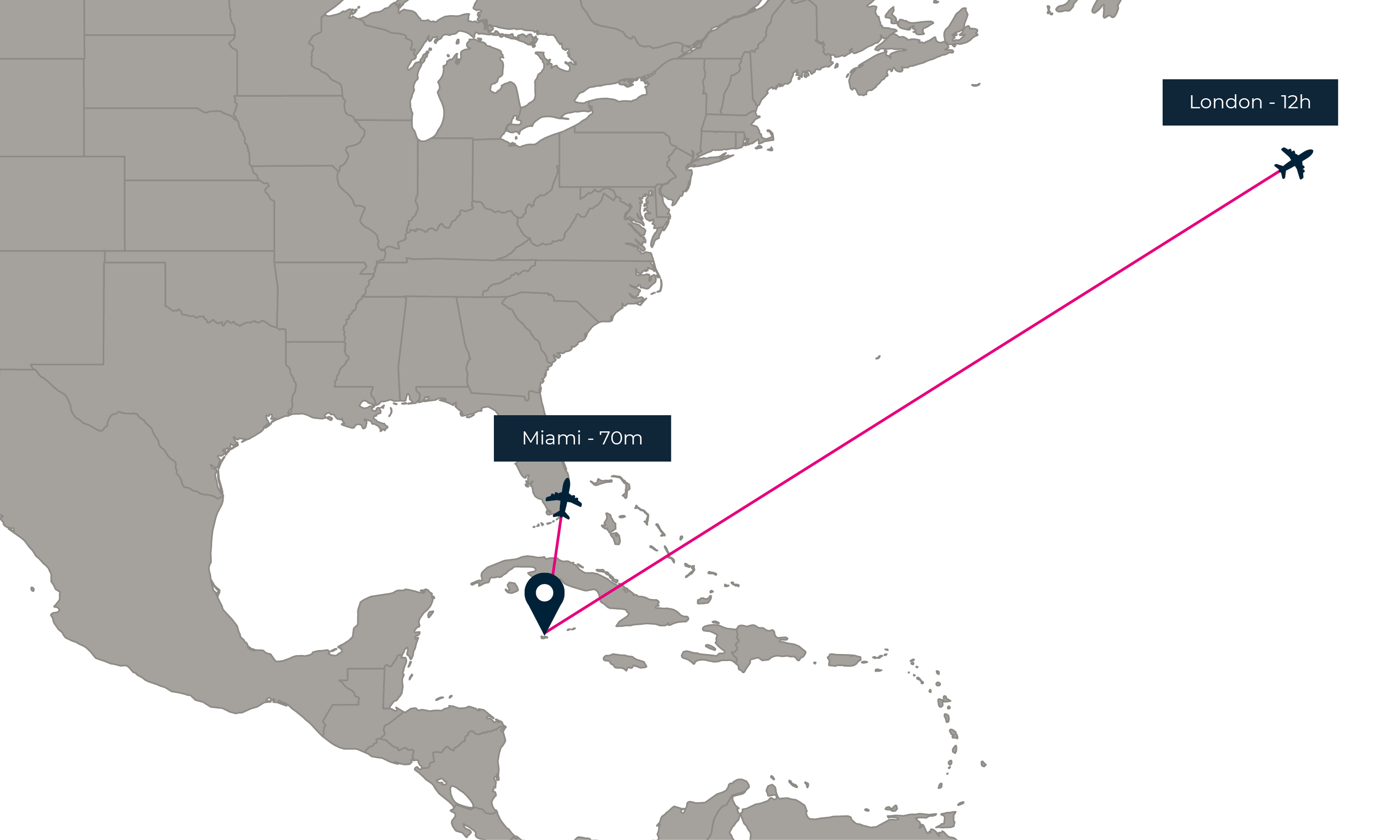

How To Get Cayman Islands Residency 7th Heaven Properties

Call Hermes For Company Formation Services In The Cayman Islands We Provide The Best In Class Services To Corporates In Cayman And Across Th Cayman Bvi Island

How To Get Cayman Islands Residency 7th Heaven Properties

Moving To The Cayman Islands Guide Provenance Properties

Cayman Islands Company Formation Services Hermes Bvi Cayman Islands Cayman

This Page Contains Information About Cayman Islands Offshore Corporate Services Provider Hermes We Will Be Glad To Serve You B Cayman Islands Cayman Island